The Case for Singapore and its Industry to Buy Sovereign Article 6 ITMOs & Support the Paris Agreement

August 24, 2024 – ITMO Ltd > Research > Insights > Download Report>>

By Michael Mathres

Chief Marketing Officer, ITMO Ltd.

As Singapore decarbonises its economy, it also recognises its limited ability to source and scale carbon credits given its constraints as a small island city state. Therefore, by implementing international cooperation through and with the new Paris Agreement Carbon Market, and aligning themselves with Article 6, Singapore and its industry can achieve its climate targets.

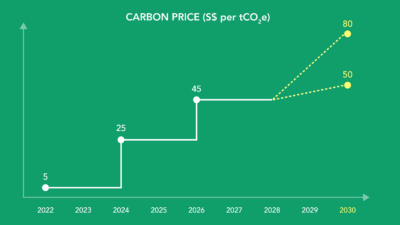

Singapore was the first South East Asian country to implement a carbon tax, on 1 January 2019. Singapore’s carbon tax currently covers 80% of its total greenhouse gas (GHG) emissions from about 50 facilities in the manufacturing, power, waste, and water sectors.The level of the carbon tax was set at S$5/tCO2e for the first five years from 2019 to 2023. The carbon tax was raised to S$25/tCO2e with effect from 2024. It will be raised to S$45/tCO2e in 2026 and 2027, with a view to reaching S$50-80/tCO2e by 2030.(2)

Singapore Carbon Tax

Singapore Carbon Tax

Graph 1: Singapore’s Prime Minister’s Office – Carbon Tax (1)

As there are not enough carbon credit sources within Singapore, companies in Singapore may use high quality international carbon credits (ICCs) to offset up to 5% of their taxable emissions from 2024.(2)

“Eligible ICCs used under the carbon tax regime will need to comply with rules under Article 6 of the Paris Agreement, and meet seven principles to demonstrate high environmental integrity. To comply with Article 6 of the Paris Agreement, the certified emissions reductions or removals must have occurred between 1 January 2021 and 31 December 2030.” – The Ministry of Sustainability and the Environment, Singapore (2023)

Eligibility Criteria for ICCs

| Principle | Definition |

|---|---|

| Not double counted | The certified emissions reductions or removals must not be counted more than once in contravention of the Paris Agreement. |

| Additional | The certified emissions reductions or removals must exceed any emissions reduction or removals required by any law or regulatory requirement of the host country, and that would otherwise have occurred in a conservative, business-as-usual scenario. |

| Real | The certified emissions reductions or removals must have been quantified based on a realistic, defensible, and conservative estimate of the amount of emissions that would have occurred in a business-as-usual scenario, assuming the project or programme that generated the certified emission reductions or removals had not been carried out. |

| Quantified & Verified | The certified emissions reductions or removals must have been calculated in a manner that is conservative and transparent, and must have been measured and verified by an accredited and independent third-party verification entity before the ICC was issued. |

| Permanent | The certified emissions reductions or removals must not be reversible, or if there is a risk that the certified emissions reductions or removals may be reversible, there must be measures in place to monitor, mitigate and compensate any material reversal of the certified emissions reductions or removals. |

| No Net Harm | The project or programme that generated the certified emissions reductions or removals must not violate any applicable laws, regulatory requirements, or international obligations of the host country. |

| No leakage | The project or programme that generated the certified emissions reductions or removals must not result in a material increase in emissions elsewhere, or if there is a risk of a material increase in emissions elsewhere, there must be measures in place to monitor, mitigate and compensate any such material increase in emissions. |

This month ITMO Ltd. has helped issue the world’s first Sovereign ITMOs with Suriname, and validated by the UN Climate Change.

“Article 6 does not allow the use of carbon credits that represent emissions reductions or removals that occurred outside of the current NDC period. To illustrate, as countries’ 2030 NDCs encompass the years 2021 to 2030, countries ought not to trade carbon credits that represent pre-2020 emissions reductions or removals.” – The Ministry of Sustainability and the Environment, Singapore (2023)

As such these Sovereign Article 6 carbon credits, comply with the Paris Agreement and fulfil the seven criteria of Singapore’s ICC:

- Not double-counted: Sovereign Article 6 ITMOs are certified emissions reductions or removals that cannot be counted more than once in contravention of the Paris Agreement, through Article 13 relating to a country’s requirement to have a national registry and to be fully transparent in its accounting.(3)

- Additional: Sovereign Article 6 ITMOs exceed any emissions reduction or removals required by any law or regulatory requirement of the host country, and that would otherwise have occurred in a conservative, business-as-usual scenario. Article 3 & 4 relating to a country’s NDC, and Article 6.2.(4)

- Real: Sovereign Article 6 ITMOs have been quantified based on a realistic, defensible, and conservative estimate of the amount of emissions that would have occurred in a business-as-usual scenario, assuming the project or programme that generated the certified emission reductions or removals had not been carried out. This is done through Article 5 and Article 6.2.(4)

- Quantified and verified: Sovereign Article 6 ITMOs have been calculated in a manner that is conservative and transparent, and must have been measured and verified by an accredited and independent third-party verification entity before the ICC was issued. This is done through Article 5.2 and the country’s national MRV system and Article 6.2.(4)

- Permanent: Sovereign Article 6 ITMOs are not reversible, as they are backward looking. So there is no risk that the certified emissions ITMOs reductions or removals may be reversible.(4)

- No net harm: Sovereign Article 6 ITMOs do not violate any applicable laws, regulatory requirements, or international obligations of the host country as it must report all its safeguards on its Biodiversity, Sustainable Development Goals and Indigenous Rights. Cancun Safeguards and Article 6.2.(4)

- No leakage: Sovereign Article 6 ITMOs do not result in a material increase in emissions elsewhere, as they represent a nationally-netted position of the whole country’s emissions. Article 6.2.(4)

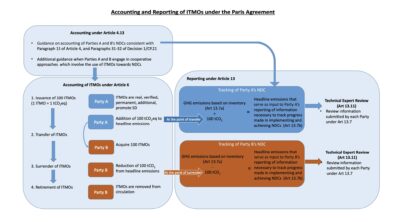

Singapore ITMOs Article 6.2

Singapore ITMOs Article 6.2

Source: UNFCCC – Accounting and Reporting of ITMOs under the Paris Agreement – Singapore Government

In conclusion, the case for Singapore and its industry to buy Sovereign Article 6 ITMOs and support the Paris Agreement is very strong. In addition, by purchasing these Article 6 Sovereign ITMOs, Singapore and its industry are contributing to a country’s NDC and global UN Biodiversity goals, United Nations Sustainable Development Goals, and UNFCCC Local and Indigenous Rights.

Key Insights

- 5%

Singapore allows 5% of companies to use International Carbon Credits - ICC Criteria

Singapore’s International Carbon Credits (ICC) have seven Criteria - Article 6

Sovereign Article 6 ITMOs fulfil the Paris Agreement

References

- Prime Minister’s Office – Singapore Government – Singapore’s Carbon Tax – https://www.nccs.gov.sg/singapores-climate-action/mitigation-efforts/carbontax/

- The Ministry of Sustainability and the Environment, Singapore – https://www.mse.gov.sg/resource-room/category/2023-10-04-eligibility-criteria-for-international%20carbon%20credits

- UNFCCC Paris Agreement – https://unfccc.int/process-and-meetings/the-paris-agreement

- UNFCCC Paris Agreement – Article 6.2 https://unfccc.int/process/the-paris-agreement/cooperative-implementation

Keyterms #

#Article6, #ParisAgreement, #Singapore, #ITMOs, #CarbonTax, #ICC, #ClimateFinance, #CarbonCredit,