Scaling Biodiversity Finance with ITMOs

The Case for Using ITMOs to Scale Biodiversity Finance & Meet the Paris Agreement & Biodiversity Global Goals

October 21, 2024 – ITMO Ltd. > Research > Insights > Download the report >>

By Michael Mathres

Chief Marketing Officer, ITMO Ltd

As the 16th Conference of the Parties to the Convention on Biological Diversity (COP 16) will take place in Cali, Colombia, this week, finance will be a key focus. Global leaders will meet to discuss the COP15 Kunming-Montreal Global Biodiversity Framework (GBF) of mobilising at least USD 200 billion annually from both public and private sources for biodiversity funding by 2030. This paper explains that there is currently only one globally-compliant Sovereign financial instrument that exists that can be scaled today to meet this goal and at the same time, the UNFCCC Paris Agreement: Biodiversity-Linked Sovereign Carbon Credit ITMOs. Download the report >>

Mind the Biodiversity Finance Gap

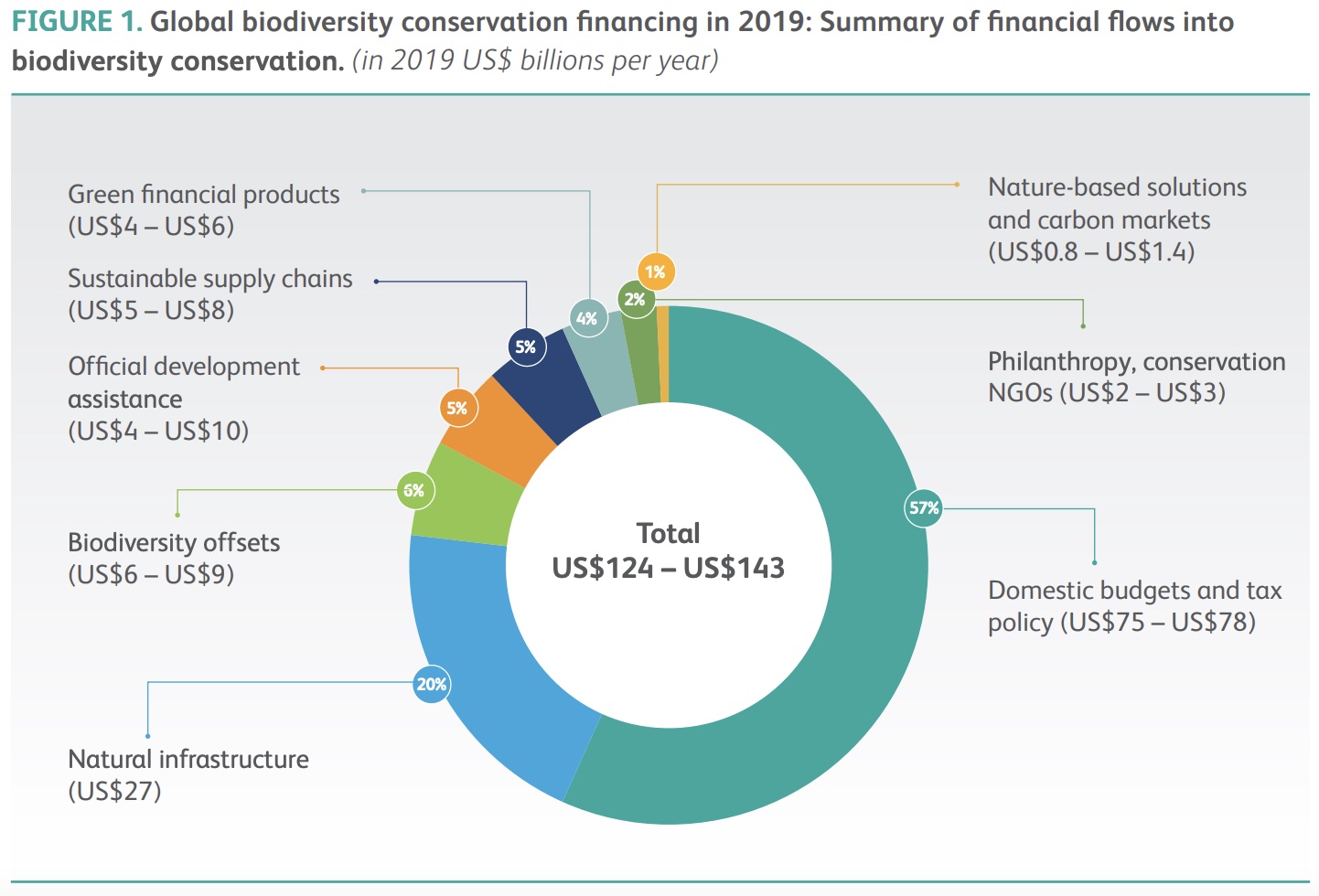

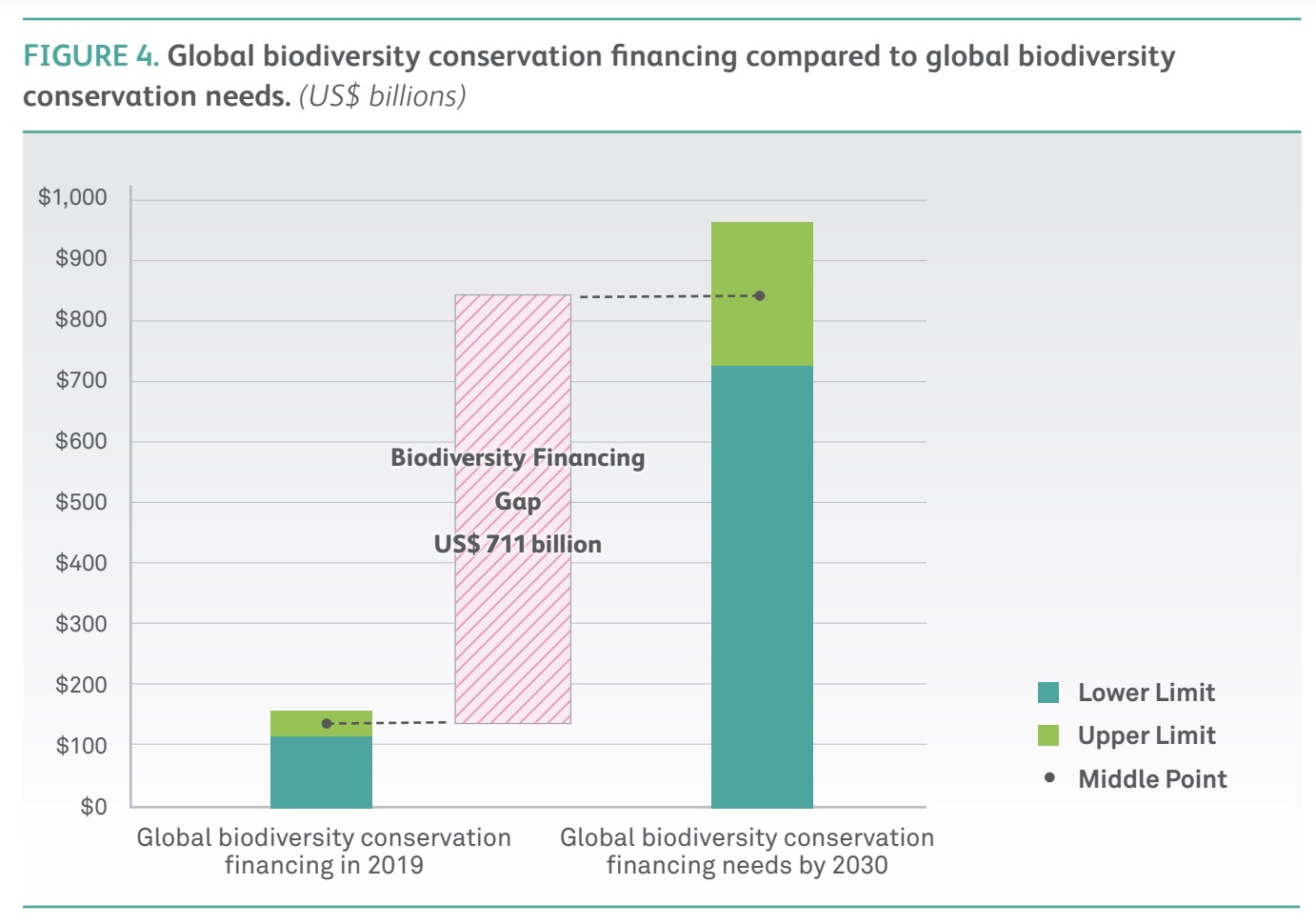

Although the Kunming-Montreal COP15 witnessed an increased engagement from representatives of the financial sector across various forums, and that biodiversity finance increased 11x since mid-2020 to about $120bn(1), the financial gap for protecting and restoring biodiversity is currently still immense. Here are some insightful statistics:

- $7tn: Environmentally harmful subsidies per year are undermining all good efforts to reach the goals and targets of the GBF.(2)

- $15tn: the amount of Assets Under Management (AUM) from the 200 financial institutions have agreed to set nature-related portfolio targets. Out of this total AUM only a mere 0.3% is invested in Biodiversity.(3)

- $600-800bn: current biodiversity finance gap per year to meet the GBF Goals by 2030.(4)

“The Global Biodiversity Gap to meet the Biodiversity Goals by 2030 is

$600-800bn per year.”

– Paulson Institute Report 2023

Biodiversity Financial Instrument Options

In 2020 the Paulson Institute wrote a seminal report on Biodiversity Finance “Financing Nature-Closing the Global Biodiversity Financing Gap”. In it the report outlines a set of nine financial and policy mechanisms that, if scaled through appropriate public policies and private sector action, have the potential to collectively make a substantial contribution to closing the global biodiversity financing gap over the next decade.(4):

- Harmful subsidy reform: (agriculture, fisheries, and forestry sectors) Subsidies deemed harmful to biodiversity are those that induce production or consumption activities that exacerbate biodiversity loss

- Biodiversity offsets: Biodiversity offsets are the last option in the mitigation hierarchy (avoid, minimize, restore, and offset), and is a biodiversity protection policy mandated by governments to compensate for unavoidable damage to biodiversity by a development project when the cause of damage proves difficult or impossible to eliminate.

- Domestic budgets and tax policy: special taxes, fees, levies, and other innovative fiscal measures that both national and subnational governments can impose to either increase revenue to fund biodiversity protection or to incentivize or disincentivize activities that benefit or degrade biodiversity

- Natural infrastructure: natural infrastructure investments maintains healthy ecosystems for the long term; and delivers ecosystem services to human populations, supporting livelihoods and communities

- Green financial products: Green financial products are a collection of financial instruments, primarily debt and equity, that facilitate the flow of investment capital into companies and projects that can have a positive impact on biodiversity.

- Nature-based solutions and carbon markets: The protection and restoration of forests and other biodiversity-rich ecosystems in what are called Nature-Based Solutions (NBS) and Natural Climate Solutions (NCS) and the active trading of carbon credits (which are issued in metric tons of carbon dioxide equivalent [tCO2e]).

- Official development assistance (ODA): Official development assistance (ODA) is broadly defined as aid, either disbursed by countries directly or through multilateral institutions, designed to support and promote the economic development and welfare of developing countries.

- Sustainable supply chains: Supply chain sustainability relates to the management of environmental, social, and governance aspects of the movement of goods and services along supply chains, from producers to consumers.

- Philanthropy and conservation NGOs: philanthropic money for the conservation, and restoration of biodiversity through non-profits.

Recent climate research has argued for a value as high as US$ 600 per ton of CO2 captured, which would imply a value for forests in their role as carbon sinks alone of more than US$ 100 trillion.

Sustainability for a Warming World (Harvard University Press, 2015)

What are Sovereign ITMOs?

ITMOs (Internationally Transferred Mitigation Outcomes) are a new globally-compliant sovereign asset class (carbon credit) that are issued by a country under the global compliance of the UNFCCC Paris Agreement-Article 6 to incentivise both, country and all 196 parties to reach their respective national biodiversity and global net-zero targets by 2030 and 2050. In the above set of various instruments, it falls under option 6: Nature-based solutions and carbon market.(4)

How are ITMOs issued?

To be able to issue ITMOs, a country has to go through two UNFCCC Paris Agreement processes: National (e.g. Article 5.2-Forests) and International (i.e. Article 6.2). In Graphic 2, we explain a National Process that a country has to go through (Article 5.2) which is the UNFCCC REDD+ crediting mechanism. This includes several nationally and internationally-compliant institutional steps. The Article 5.2 Process includes:(5)

- National Plan: Develop a National UNFCCC REDD+ strategy or action plan

- National MRV: Establish a UNFCCC National Forest Monitoring system of Measurement, Reporting and Verification (MRV) for all of the country’s forests

- National Safeguards: Establish a UNFCCC National Safeguards Information System for its sovereign Biodiversity, Sustainable Development Goals (SDGs), and Local and Indigenous Peoples Rights.

- First Review: Submit a FREL/FRL1 for technical assessment under the UNFCCC

- Nationally Determined Contribution (NDC): Implement policies and measures for climate mitigation in line with the country’s climate plan or NDC.

- MRV Implementation: Monitor emissions & removals, estimate REDD+ results against the FREL/FRL1

- Second Review: Submit a BTR2 with a Technical Annex including REDD+ results to the UNFCCC for verification

- Results: REDD+ Results are posted on the UNFCCC Lima Information Hub

1: Forest reference emissions level and/or forest reference level (FREL/FRL)

2: Biennial Transparency Report (BTR) under the Paris Agreement

UNFCCC-Article-5.2-Process

UNFCCC-Article-5.2-Process

Graph 2: UNFCCC Paris Agreement Article 5.2 Process

Once a country has submitted its results to the UNFCCC and it has been verified and accepted, a country can decide to issue ITMOs under Article 6.2. For the purpose of this paper, we will not go through each individual steps a country has to fulfil, and we invite you to read the report published by the German Government’s Ministry of Economic Affairs and Climate Action if you want to understand the whole Article 6.2 process explained in detail.(6)

How do ITMOs fit Biodiversity Finance Policies & Instruments?

In order to create economic incentives for businesses and financial institutions to maximise the mobilisation of private finance for our biodiversity, ITMOs address all the economic and policy challenges identified by both the Finance for Biodiversity Foundation and the Paulson Institute report. Here they are and how ITMOs address them (we are using as an example the recent ITMO issuance by Suriname)(7):

Finance for Biodiversity Foundation Recommendations-

-

Action 10:

Initiate coordination between ministries to ensure whole-of-government, economy-wide sectoral approach

ITMOs are achieved at National level and need to be co-ordinated by many ministries and across sectors.

- Action 11: Reorient sectoral regulation, including tax policies, market mechanisms, and subsidies to incentivise business practices that protect and restore biodiversity

ITMOs incentivise market mechanisms Nationally to protect and restore biodiversity

- Action 12: Develop sovereign green finance instruments by ministries of finance

ITMOs are issued by the national government of a country and are therefore a sovereign green finance instrument.

- Action 13: Mobilise private sector financing and investment for biodiversity through the use of private-public instruments.

- ITMOs issued by the national government can be sold to the private sector

Paulson Institute report Challenges identified:

- Biodiversity Policy: Countries must take immediate policy actions to protect their natural capital and expand biodiversity conservation financing

- ITMOs solution: A country must implement a Sovereign Biodiversity plan under the Cancun Safeguards of the Paris Agreement.(8)

- Government and philanthropic donors: should use their funds strategically to support countries to implement the financing mechanisms identified in this report and to catalyze subsequent public and private sector investment

- ITMOs solution: A government must explain in a transparent way their use of funds under Article 13.(9)

- National and subnational governments should strengthen their regulatory and financial enabling conditions to significantly accelerate private sector actions and finance for biodiversity conservation.

- ITMOs solution: A country needs to implement a national plan and system under Article 5.(10)

- Private sector actors should implement the recommendations from the sections on sustainable supply chains, harmful subsidy reform, natural infrastructure, biodiversity offsets, nature-based solutions and carbon markets, green investment, and investment risk management to both increase their opportunities to invest in biodiversity and minimize their biodiversity-related financial risks

- ITMOs solution: Private sector actors can buy or invest in a country’s Sovereign biodiversity-linked ITMOs and de-risk their biodiversity risk in that country and the globe.

- Governments and international agencies should improve tracking and reporting on biodiversity finance. Some of the best data collection and analysis that are available are spread across the OECD, UNDP’s BIOFIN initiative and the CBD Secretariat. Additional public funding should be secured to support these institutions to enhance global finance data collection and build capacity of governments to collect and share data

- ITMOs solution: A government must explain in a transparent way their use of funds under Article 13.(9)

- UN CBD Plans: In the context of the UN Convention on Biological Diversity negotiations, Parties should agree to develop and implement National Biodiversity Finance Plans (NBFPs) to guide the implementation of their national efforts toward the CBD’s new Global Biodiversity Framework.

– ITMOs solution: A government must implement a Sovereign Biodiversity Safeguard plan.(8)

In Conclusion

There are many options a private corporation or investor can use to increase Biodiversity Finance globally. All these financial instrument options have been identified by the Paulson Institute report-Financing Nature. But to be able to scale Biodiversity Finance properly, a corporate or investor needs a solution that is currently available and fulfils the global requirements and compliance of existing international agreements such as the UNFCCC Paris Agreement and the UN Convention on Biological Diversity (CBD) goals.

This report showcased how investors, corporations and governments can do so by using globally-compliant and biodiversity-linked Sovereign ITMOs, which falls under the nature-based finance and carbon market option of the Paulson report.

Moreover, we need to create economic incentives for businesses and financial institutions to maximise the mobilisation of private finance for our biodiversity. ITMOs is a great way of doing so as it also answers all the actions identified by the Finance for Biodiversity Foundation and all the challenges identified by the Paulson Institute.(11)

ITMOs (Internationally Transferred Mitigation Outcomes) are a new Biodiversity-linked and globally-compliant sovereign asset class (carbon credit) that are issued by a country under the global compliance of the UNFCCC Paris Agreement-Article 6 to incentivise both, country and all 196 parties to reach their respective national and global net-zero and biodiversity targets by 2030 and 2050. We invite you to be explore ITMOs in more details and scale ITMOs globally. Please ask us to have access to our Virtual Data Room.

-END-

Disclaimer: This material is provided to you by ITMO Limited solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or commitment or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Key Insights

- $7tn

Environmentally harmful subsidies per year - $100tn

Value of forests if they were carbon-priced correctly - $600-800bn

Current biodiversity finance gap/yr. to meet the 2030 goals

Scaling Biodiversity Finance with ITMOs

References

- ITMO Ltd – ITMO Ltd and BancTrust Investment Bank Limited Announce the Offering of the World’s First Sovereign Carbon Credits from the Republic of Suriname under Article 6 of the Paris Agreement https://www.itmo.com/wp-content/uploads/2024/08/ITMO-BancTrust-Suriname-Press-Release-August-23_2024.pdf

- UNFCCC Paris Agreement – https://unfccc.int/process-and-meetings/the-paris-agreement

- UN Convention on Biological Diversity Goals – https://www.cbd.int/article/cop15-cbd-press-release-final-19dec2022

- WWF (2023). The Forest Pathways Report. Gagen, M.H., Dudley, N., Jennings, S., Timmins, H.L. Baldwin Cantello, W., D’Arcy, L., Dodsworth, J.E., Fleming, D., Kleymann, H., Pacheco, P., Price, F., (Lead Authors). WWF, Gland, Switzerland. https://files.worldwildlife.org/wwfcmsprod/files/Publication/file/7nxri5veo8_WWF_Forest_Pathways_Report_2023_ Web.pdf

- Forest Declaration Assessment & Systems Change Lab (2023). Glasgow Leaders’ Declaration Dashboard, Article 5. https://dashboard.forestdeclaration.org/increase-effective-accessible-finance-for-forests-and-land/

- Forest Declaration Assessment Partners. (2023). Off track and falling behind: Tracking progress on 2030 forest goals. Climate Focus (coordinator and editor). https://forestdeclaration.org/resources/forest-declaration-assessment-2023/

- Global Canopy (2023). 2023: A watershed year for action on deforestation: Annual Report 2023. Oxford, England: Global Canopy. https:// forest500.org/publications/2023-watershed-year-action-deforestation/

- Transition Pathway Initiative – State of Transition in the Banking Sector report 2024 https://www.transitionpathwayinitiative.org/publications/89/show_news_article

- UN Climate Change Conference UK 2021 (2021). Glasgow Leaders’ Declaration on Forests and Land Use. https://ukcop26.org/glasgow-leaders-declaration-onforests-and-land-use/

- Forest Declaration Assessment Report 2024 – https://forestdeclaration.org/resources/emerging-forest-finance-instruments/

- UNFCCC Paris Agreement – Article 6 https://unfccc.int/process/the-paris-agreement/cooperative-implementation

- Ministry of Economic Affairs and Climate Action-Carbon Mechanism Review-VOL. 12 | NO. 3 AUTUMN 2024-How Article 6 brings Article 5.2 REDD+ to Global Carbon Markets https://www.carbon-mechanisms.de/en/publications/details/cmr-03-2024

- UNFCCC Paris Agreement – Article 5 – https://unfccc.int/process-and-meetings/the-paris-agreement

- UNFCCC Cancun Safeguards – https://redd.unfccc.int/fact-sheets/safeguards.html

- EU European Commission – Delivering the European Green Deal – https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en

Keyterms #

#Article6, #ParisAgreement, #EU, #Biodiversity, #ITMOs, #BiodiversityFinance, #ClimateFinance, #CarbonCredit, #COP16