Investing in Natural Capital with ITMOs

The Case for Using ITMOs to Invest in Natural Capital, meet the Paris Agreement & Biodiversity Global Goals

October 12, 2024 – ITMO Ltd. > Research > Insights > Download the report >>

By Michael Mathres

Chief Marketing Officer, ITMO Ltd

Almost all of global GDP depends on nature and biodiversity and is crucial for the sustainable socioeconomic development of the world. But, our planet’s natural capital that keeps us alive, such as rainforests, water and soil, is massively depleted today. This insight report aims to explain the use of ITMOs and how to address, mobilise and scale more private investments in natural capital meet the UN Biodiversity and the UNFCCC Paris Agreement goals.(1) Download the report >>

Natural Capital & ITMOs

The World Economic Forum estimates that paying for the use of natural capital, and protecting nature and biodiversity, could generate $10 trillion annually and 400 million jobs in the future.(2) However, today’s macroeconomic models do not incorporate or incentivise nature to drive economic growth and the world’s GDP. This is because, the broader benefits and services derived from ecosystems (rainforest, water and pollination) are largely or completely undervalued and mis-priced in the global economy. This has created limited asset classes for investors and governments to mobilise, grow and invest in natural capital at scale.

“Natural capital is the world’s stock of renewable and non-renewable natural resources that combine to yield a flow of benefits to people.” – World Economic Forum definition 2024

Since the launch of the world’s first globally compliant carbon credits (ITMOs) from the Republic of Suriname under the UNFCCC Paris Agreement(3) in August 2024(4), there is now a new institutional asset class for private investors and governments to engage in protecting, restoring, and enhancing natural capital in the ITMO issuing country, while respecting all of its sovereign biodiversity. ITMOs are an innovative financial instrument, that can be used by investors, corporations and governments to directly invest in natural capital at scale, as it is done at national and international level. This report explores this new innovation and mechanism.

Today, investing in natural capital is crucial, doable and scalable

Our planet’s natural capital is in a dire situation. Species populations have declined by 73% since 1970, with the most significant losses in Latin America and Africa.(5) More than 420 million hectares of forests have been lost in the past 30 years – an area nearly half the size of Canada’s entire land mass. Natural capital per capita dropped by 40% in 1992–2014, while produced capital doubled in the same period.(6)

The United Nations Environment Programme’s (UNEP) State of Finance for Nature estimates that nature- negative financial flows totalled nearly $7 trillion in 2022, including $1.7 trillion of harmful public subsidies primarily in agriculture and energy and more than $5 trillion in private-sector impact, particularly from primary and secondary sectors.(7)

It is therefore crucial that investors have access to a financial instrument that is both nationally and internationally recognised and that can be scaled quickly. ITMOs under the UNFCCC Paris Agreement offer just that, and more as it complements all of the following existing instruments and international objectives:

1. Nature Positive Finance: ITMOs contribute to the nature positive economy that requires $2.7 trillion of annual capital investment through to 2030.(8) The Paulson Institute estimates that the nature-finance gap may be significantly higher – an average of $711 billion annually.(9)

2. The Kunming–Montreal Global Biodiversity Framework (GBF): ITMOs help fulfil the Convention on Biological Diversity (CDB) 2030 targets, and its outlined goal of mobilising an additional $200 billion per year by 2030 for biodiversity from domestic, international, public and private sources, via Target 19.(10)

3. Leveraging Public Finance: Governments around the world can use ITMOs to provide the most funding for protecting, restoring and enhancing nature – around 82% of total financial flows or $165 billion annually. (11)

4. Leveraging Philanthropic Finance: ITMOs can be used by philanthropic finance organisations for climate mitigation and scale up the less than 2% of the estimated $810 billion of donations in 2021 – well behind economic development, health, education and community development.(12, 13)

ITMOs-in-Natural-Capital

ITMOs-in-Natural-Capital

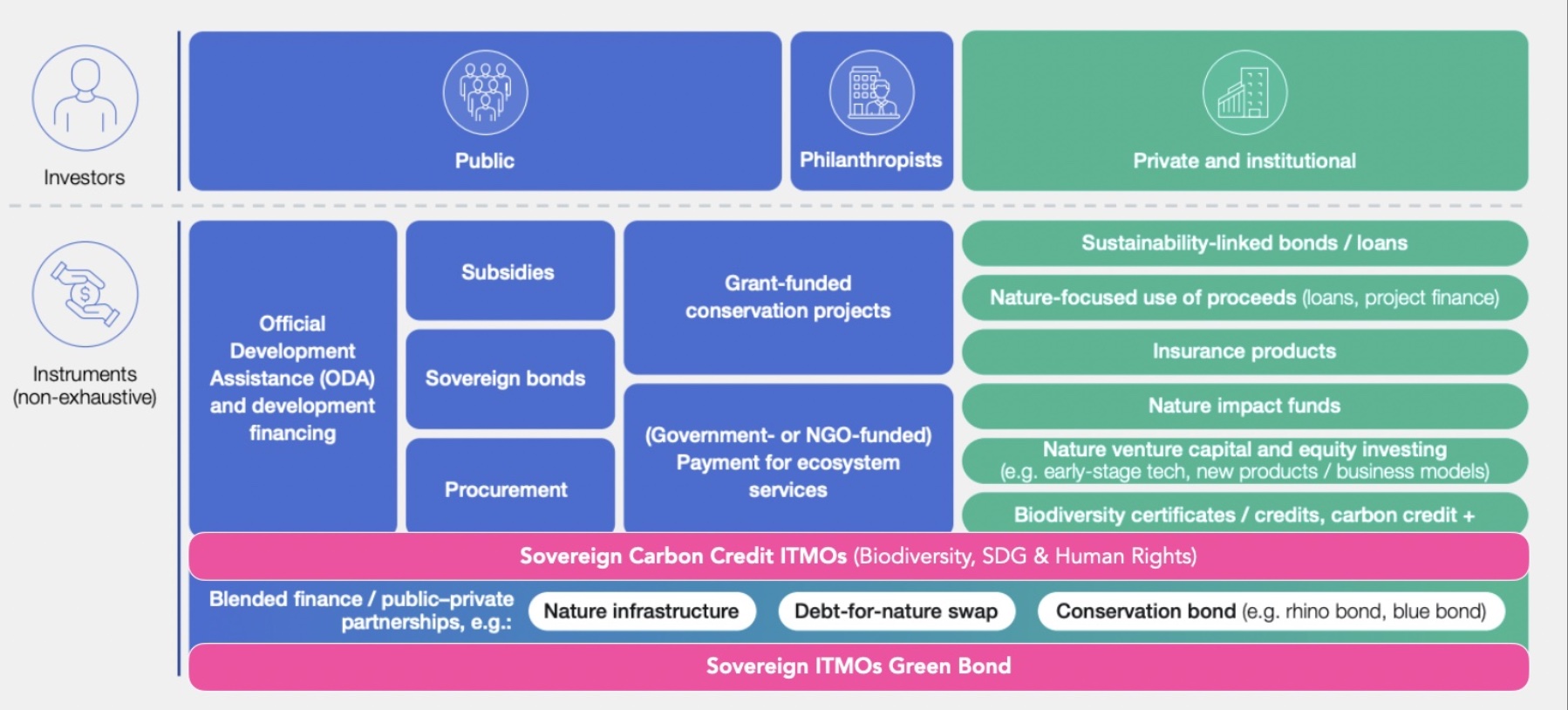

Graph 1: ITMOs in Natural Capital Ecosystem – Source: World Economic Forum and ITMO Ltd adapted

Innovating Natural Capital with ITMOs

According to the World Economic Forum’s Future of Nature and Business report (2024)(14), there are 60 new innovative financial models across three key socioeconomic systems that could collectively be worth $10.1 trillion in additional business value by 2030. However, the “Sovereign ITMOs” model was not included, probably because of its recent public launch in August 2024. The graphic above includes Sovereign ITMOs in pink and also as a Green Bond option. For the purpose of this paper, we will focus solely on Sovereign Carbon Credit ITMOs, not Sovereign ITMOs Green Bond option, which we will delve into a future report.

What are ITMOs?

ITMOs (Internationally Transferred Mitigation Outcomes) are a new globally-compliant sovereign asset class (carbon credit) that are issued by a country under the global compliance of the UNFCCC Paris Agreement’s Article 6 to incentivise both, country and all 196 parties to reach their respective national and global net-zero targets by 2030 and 2050.(15)

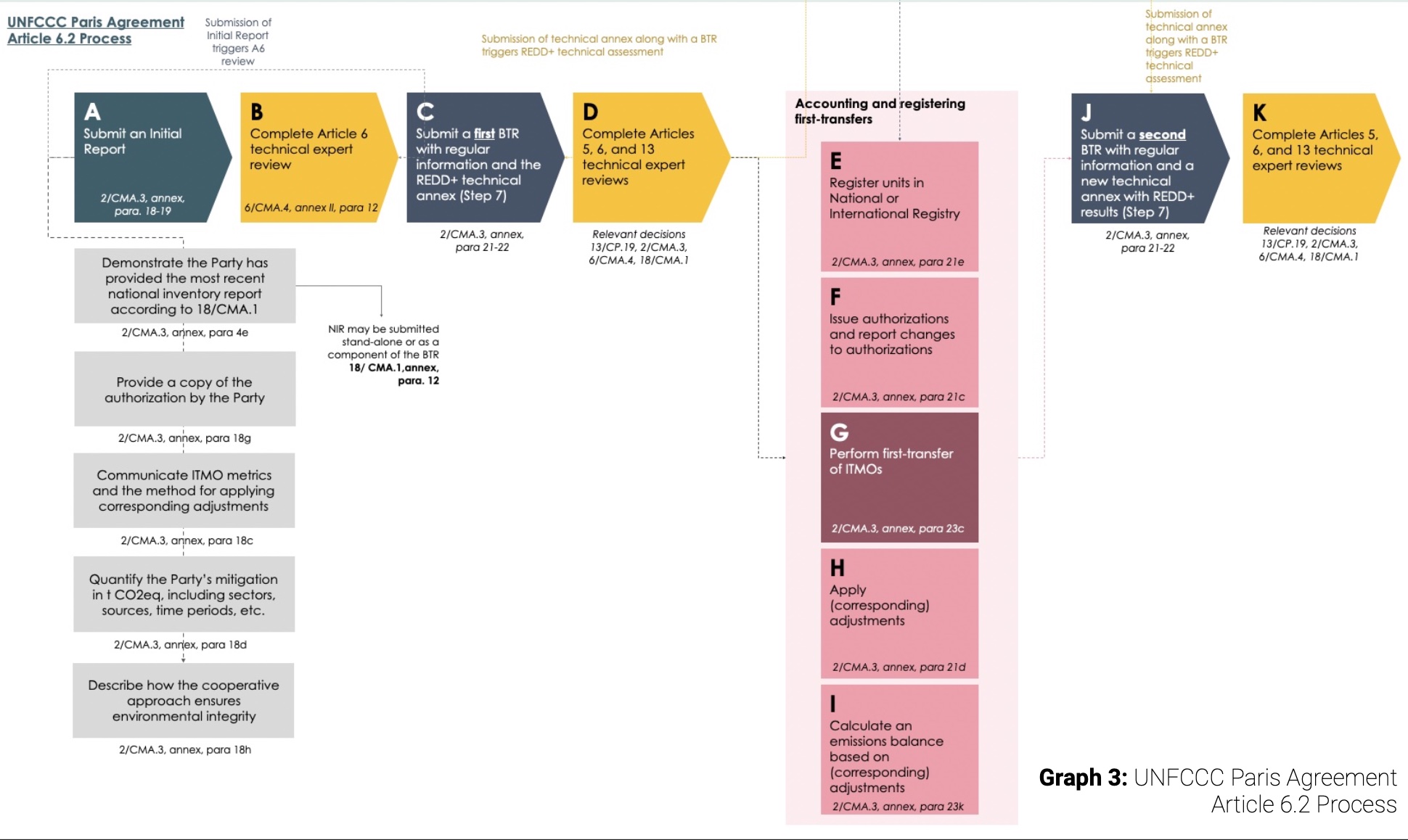

How are ITMOs issued?

To be able to issue ITMOs, a country has to go through two UNFCCC Paris Agreement processes: National (e.g. Article 5.2-Forests) and International (i.e. Article 6.2). In Graphic 2, we explain a National Process that a country has to go through (Article 5.2) which is the UNFCCC REDD+ crediting mechanism. This includes several nationally and internationally-compliant institutional steps. Article 5.2 Process(16):

- National Plan: Develop a National UNFCCC REDD+ strategy or action plan

- National MRV: Establish a UNFCCC National Forest Monitoring system of Measurement, Reporting and Verification (MRV) for all of the country’s forests

- National Safeguards System: Establish a UNFCCC National Safeguards Information System for its sovereign biodiversity, Sustainable Development Goals (SDGs), and Local and Indigenous Peoples Rights.

- First Review: Submit a FREL/FRL1 for technical assessment under the UNFCCC.

- Nationally Determined Contribution (NDC): Implement policies and measures for climate mitigation in line with the country’s climate plan or NDC.

- MRV Implementation: Monitor emissions & removals, estimate REDD+ results against the FREL/FRL1

- Second Review: Submit a BTR2 with a Technical Annex including REDD+ results to the UNFCCC for verification

- Results: REDD+ Results are posted on the UNFCCC Lima Information Hub

1: Forest reference emissions level and/or forest reference level (FREL/FRL)

2: Biennial Transparency Report (BTR) under the Paris Agreement

Once a country has submitted its results to the UNFCCC and it has been verified and accepted, a country can decide to issue ITMOs under Article 6.2. For the purpose of this paper, we will not go through each individual steps a country has to fulfil, and we invite you to read the report published by the German Government’s Ministry of Economic Affairs and Climate Action if you want to understand the whole Article 6.2 process explained in detail.(16)

Key Challenges Addressed by ITMOs for More Natural Capital

In its Future of Nature and Business 2024 report, the World Economic Forum highlighted five key challenges that need to be addressed in order to support greater investment in natural capital. A country’s Sovereign ITMOs address 4 out of the 5 challenges in the following ways:

1. Improved MRV: accessibility, relevance and affordability of technological advances in nature monitoring, and embedding these deeper in decision-making.

• ITMOs solution: Under Article 5 the MRV system is done at national level, not project level and is accessible, and relevant nationally. This MRV system can be replicated to other countries more effectively and affordably. (Please see Graph 2)

2. Transparency: Development of sophisticated capital markets infrastructure to ensure transparency, accountability and the efficient flow of capital to nature-positive projects.

• ITMOs solution: Under Article 13 transparency, accountability and efficient flow of capital is already engrained in the Paris Agreement. This is done at national level not project level, therefore offers scalability to investors.(17)

3. Improved Valuation & Pricing: Improving valuation and pricing of natural capital, so that natural capital investments can compete with traditional business models, driven by better technologies, supportive policies and strengthened collaboration.

• ITMOs (ongoing): As part of the Suriname ITMOs syndication process, current valuation and pricing of being undertaken. Early market signals indicate that ITMOs are being valued at the high-end of carbon credit valuation and pricing, with estimates of $50bn by 2030.(4)

4. Impact & Returns: More patient and catalytic capital that aligns with the speed of nature, allowing for both impacts and returns to be achieved over a longer time horizon.

• ITMOs solution: As ITMOs are backward looking, the impact and returns are already known and are adapted on nature’s (biodiversity and forests) annual growth. This impact and results can be extrapolated into the future. Please see Suriname’s ITMOs registry for further ITMOs.(18)

5. Inclusion of Local Peoples: living and depending on nature – as active participants and decision makers in projects, businesses and initiatives, and appropriate and fair benefit-sharing and governance mechanisms.

• ITMOs solution: As part of the Safeguards System (Step 3 in Graphic 2) Local and Indigenous Rights need to be respected before issuing ITMOs. Furthermore, ITMO-issuing countries such as Suriname must include a fair benefit-sharing scheme with Local and Indigenous Peoples. (19)

In Conclusion

There are many ways one can invest in natural capital, but to be able to do it at scale requires a national and international framework that an investor can verify. This report showcased how investors, corporations and governments can do so through the purchase of globally-compliant Sovereign ITMOs under the UNFCCC Paris Agreement.

ITMOs (Internationally Transferred Mitigation Outcomes) are a new globally-compliant sovereign asset class (carbon credit) that are issued by a country under the global compliance of the UNFCCC Paris Agreement- Article 6 to incentivise both, country and all 196 parties to reach their respective national and global net-zero targets by 2030 and 2050.

In addition to providing Natural Capital at scale, ITMOs already address 4 out of the 5 key challenges determined by the World Economic Forum’s: MRV, Transparency, Impact/Returns and Inclusion of Local Peoples. The valuation of ITMOs are currently being assessed through a syndication process of the world’s first Sovereign ITMOs. We invite you to be part of this ITMOs syndication process and scale natural capital. Please ask us to have access to our Virtual Data Room.

-END-

Disclaimer: This material is provided to you by ITMO Limited solely for informational purposes, is intended for your use only and does not constitute an offer or commitment, a solicitation of an offer or commitment or any advice or recommendation, to enter into or conclude any transaction (whether on the indicative terms shown or otherwise), or to provide investment services in any state or country where such an offer or solicitation or provision would be illegal.

Key Insights

- $10tn

Value of Natural Capital Markets by 2030 - $165bn

Amount of government finance towards nature in 2023 - $50bn

Market value of Sovereign ITMOs by 2030

Investing in Natural Capital with ITMOs

References

(1) World Economic Forum. (2019). Nature risk rising. https://www.weforum.org/publications/nature-risk-rising-why- thecrisis-engulfing-nature-matters-for-business-and-the-economy/

(2) World Economic Forum. (2020, July 14). New Nature Economy report II: The future of nature and business. https:// www3.weforum.org/docs/WEF_The_Future_Of_Nature_And_Business_2020.pdf

(3) UNFCCC – Paris Agreement 2015

(4) ITMO Ltd – ITMO Ltd and BancTrust Investment Bank Limited Announce the Offering of the World’s First Sovereign

Carbon Credits from the Republic of Suriname under Article 6 of the Paris Agreement https://www.itmo.com/wp-

content/uploads/2024/08/ITMO-BancTrust-Suriname-Press-Release-August-23_2024.pdf

(5) World Wildlife Fund (WWF). (2024). Living planet report 2024. https://www.worldwildlife.org/pages/living-

(6) Dasgupta, P. (2021). The economics of biodiversity: The Dasgupta Review. https://assets.publishing.service.gov.uk/

(7) United Nations Environment Programme. (2023). State of finance for nature 2023. https://www.unep.org/resources/

(8) World Economic Forum. (2020). The future of nature and business. https://www.weforum.org/publications/new-

natureeconomy-report-ii-the-future-of-nature-and-business/

(9) The Paulson Institute

(10) Convention on Biological Diversity. (2022). The biodiversity plan for life on Earth: 2030 targets (with guidance notes).

https://www.cbd.int/gbf/targets

(11) United Nations Environment Programme. (2023). State of finance for nature 2023. https://www.unep.org/resources/

(12) World Economic Forum. (2023, January 17). New initiative to help unlock $3 trillion needed a year for climate and

nature [Press release]. https://www.weforum.org/press/2023/01/new-initiative-to-help-unlock-3-trillion-needed-a-year-

(13) Rockefeller Philanthropy Advisory. (2022, July 20). New survey report: Global trends and strategic time horizons in

philanthropy, 2022. https://www.rockpa.org/global-trends-and-strategic-time-horizons-in-philanthropy-2022/

(14) World Economic Forum. (2020). The future of nature and business. https://www.weforum.org/publications/new-

natureeconomy-report-ii-the-future-of-nature-and-business/

(15) UNFCCC https://unfccc.int/process/the-paris-agreement/cooperative-implementation

(16) Ministry of Economic Affairs and Climate Action-Carbon Mechanism Review-VOL. 12 | NO. 3 AUTUMN 2024-How

Article 6 brings Article 5.2 REDD+ to Global Carbon Markets https://www.carbon-mechanisms.de/en/publications/

(17) UNFCCC Paris Agreement – https://unfccc.int/process-and-meetings/the-paris-agreement

(18) ITMO Ltd – Suriname ITMO National Registry – https://mer.markit.com/br-reg/public/cfrn-public/#/nation-details (19) UNFCCC Cancun Safeguards – https://redd.unfccc.int/fact-sheets/safeguards.html

Keyterms #

#Article6, #ParisAgreement, #EU, #EuropeanUnion, #ITMOs, #CarbonTax, #CBAM, #ClimateFinance, #CarbonCredit