*ITMO Limited is building the global Compliance Carbon Market (CCM) under the UNFCCC Paris Agreement’s Article 6 with more than 50 countries.

ITMO Ltd. sources, structures and sells globally compliant Carbon Credits (ITMOs) to corporates, the capital markets and governments at Gigaton Scale, with Economic, Social and Environmental Benefits such as Biodiversity, Local & Indigenous Rights, and the Sustainable Development Goals (SDGs). ITMO does this through three different units:

– ITMO Capital: Selling, syndicating & distributing of Article 6 sovereign carbon assets

– ITMO Tech: Building the Article 6 global tech infrastructure, platform & national registries

– ITMO R&D: Providing advisroy, data & research for Article 6 implementation

Buy Article 6 Carbon Credits >>

Go to the Country’s National Registry

(Suriname National Registry with S&P Global)

ITMO at COP30, Belem, Brazil

Coalition for Rainforest Nations Pavilion, Blue Zone, UNFCCC

ARTICLE 6 Centre of Excellence (ACE)

ITMO Ltd is delighted to launch the Article 6 Centre of Excellence (ACE) at COP30 from Nov 10-21 to discuss and implement best practice of Article 6. Every day, we will be holding Article 6 discussions, and bilateral meetings in the Blue Zone of the UNFCCC COP30. Should you require a speaker or expert on Article 6 please contact us: Michael Mathres at michael@itmo.com. #Article6 #COP30 #ParisAgreement #ITMOs #ClimateFinance #CarbonCredits #CarbonMarkets

Catalysing the new trillion-dollar global Compliance Carbon Market (CCM)

ITMO Limited is dedicated to catalyse and develop the new global multi-billion Dollar Compliance Carbon Market (CCM) at speed and scale.

On June 26th 2024, Suriname became the first country in the World to issue globally compliant Sovereign Carbon Credits (ITMOs) under Article 6 of the Paris Agreement.

TO FIND OUT MORE >> READ THE PRESS RELEASE, READ THE NEWS or DOWNLOAD OUR BROCHURE & DECK

News

The latest news from ITMO Limited, the Global Compliance Carbon Market (CCM), ITMOs & the UNFCCC Paris Agreement Article 6.

Please visit our LinkedIn page. #Article6 #ITMOs #CCM #ComplianceCarbonMarket #ParisAgreement

Buy the World’s First Globally Compliant

Article 6 Carbon Credits ITMOs

In 2024 ITMO Limited has become the world’s first company to source globally compliant ITMOs carbon credits.

ITMO is also the world’s first company to build a globally compliant and regulated Article 6 national registry.

Compliant Carbon Credits

ITMO Limited sourced the world’s first globally compliant Article 6 Carbon Credits (ITMOs) under the Paris Agreement with Suriname.

Regulated National Registry

Suriname is the first country to have an Article 6 (ITMOs) registry under the Paris Agreement. Please ask us to have access.

National & International Due Diligence Data Room

Largest data room with 50+ documents explaining the framework, processes, and steps to issue Article 6 carbon credits.

Global Leading Expert and Pioneer on National & Global Compliance of the

Paris Agreement, Article 6 Carbon Credits & the Compliance Carbon Market (CCM)

ITMO Limited is the global leading expert on the global Compliance Carbon Market (CCM) and Article 6 Carbon Credits (ITMOs) under the UNFCCC Paris Agreement. Since Article 6 was signed in 2021 at COP26 in Glasgow, ITMO Ltd has worked with more than 10+ countries, and has gained unparalleled knowledge, access to Sovereign carbon credit supply, gathered hundreds of research reports and data points to share with the private sector, corporate buyers, investors and the capital markets at large. #Article6 #ParisAgreement #ITMOs

>200m tCO2e

Working on issuing >200m tCO2e ITMOs

400+ Reports

Our database has >400 reports on Article 6

300+ Buyers

Engaged w/ 300+ buyers interested in Article 6

50+ Countries

Access to >50 countries to develop their ITMOs and market

Research – ITMO Insights

Latest ITMO Research Insights into the global Compliance Carbon Market (CCM), ITMOs, the Paris Agreement & Article 6.

#Article6 #ParisAgreement #ITMOs

Scaling Biodiversity Finance with ITMOs

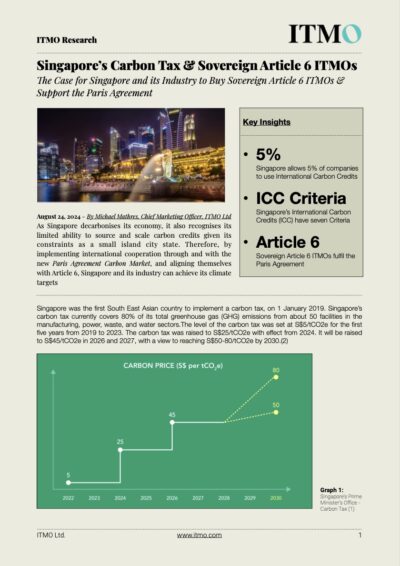

Singapore’s Carbon Tax & Sovereign Article 6 ITMOs

As Singapore decarbonises its economy, it also recognises its limited ability to source and scale carbon credits given its constraints as a small island city state. Therefore, by implementing international cooperation through and with the new Paris Agreement Carbon Market… READ REPORT >>

Integrating Article 6 ITMOs into the EU’s CBAM

As Carbon Credits from Article 6 of the Paris Agreement could be used in regulated carbon markets, a new report written by HFW and Climate Action Center of Excellence (CACE) proposes how these ITMOs could be integrated into the EU’s Carbon Border Adjustment… READ REPORT >>

Global Memberships, Awards & Support

ITMO Limited is a proud member and supporter of the following global climate, nature and biodiversity finance initiatives: